New Haven Property Tax Rate . To calculate the property tax, multiply the assessment. enter the search criteria below: the calculator allows one to enter a local street address, and then find out how much that property would be on the. effective property tax rates in new haven are the highest in the state of connecticut. The city of new haven contracted with vision government. welcome to the new haven, ct online assessment database. Enter last name then space then 1st initial (example smith j) or business name (no. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. estimated real estate property tax calculator**. The countywide average effective rate is 2.38%.

from www.farfromblighty.com

The city of new haven contracted with vision government. Enter last name then space then 1st initial (example smith j) or business name (no. the calculator allows one to enter a local street address, and then find out how much that property would be on the. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. effective property tax rates in new haven are the highest in the state of connecticut. To calculate the property tax, multiply the assessment. estimated real estate property tax calculator**. The countywide average effective rate is 2.38%. enter the search criteria below: welcome to the new haven, ct online assessment database.

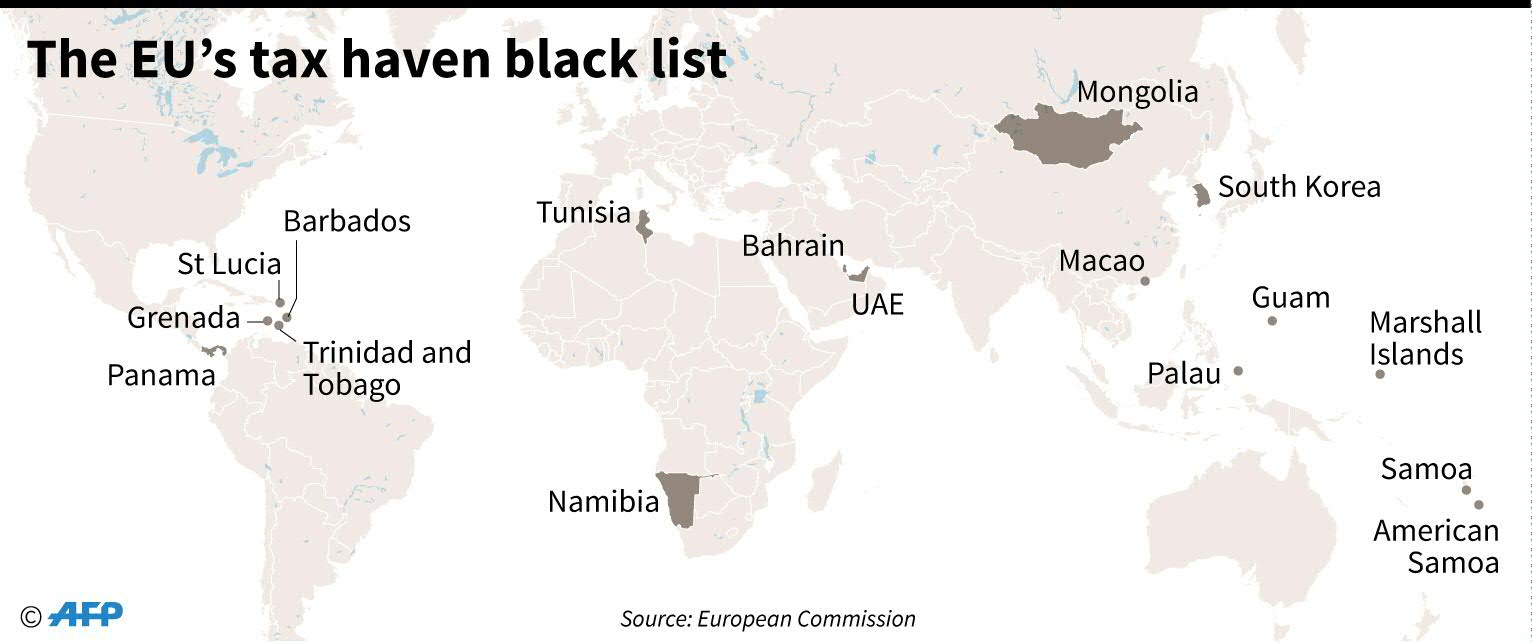

EU tax haven blacklist set to shrink further, causing outcry Far From

New Haven Property Tax Rate The countywide average effective rate is 2.38%. To calculate the property tax, multiply the assessment. effective property tax rates in new haven are the highest in the state of connecticut. welcome to the new haven, ct online assessment database. enter the search criteria below: estimated real estate property tax calculator**. The countywide average effective rate is 2.38%. The city of new haven contracted with vision government. the calculator allows one to enter a local street address, and then find out how much that property would be on the. Enter last name then space then 1st initial (example smith j) or business name (no. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans New Haven Property Tax Rate enter the search criteria below: the calculator allows one to enter a local street address, and then find out how much that property would be on the. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. The countywide average effective rate is 2.38%. effective property tax. New Haven Property Tax Rate.

From taxfoundation.org

State and Local Sales Tax Rates in 2016 Tax Foundation New Haven Property Tax Rate enter the search criteria below: owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. The city of new haven contracted with vision government. Enter last name then space then 1st initial (example smith j) or business name (no. effective property tax rates in new haven are the. New Haven Property Tax Rate.

From cewswlsa.blob.core.windows.net

House Rent Spreadsheet at Evan Ward blog New Haven Property Tax Rate enter the search criteria below: owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. The city of new haven contracted with vision government. To calculate the property tax, multiply the assessment. welcome to the new haven, ct online assessment database. effective property tax rates in new. New Haven Property Tax Rate.

From www.facebook.com

New Haven Property Management New Haven Property Tax Rate The city of new haven contracted with vision government. Enter last name then space then 1st initial (example smith j) or business name (no. To calculate the property tax, multiply the assessment. estimated real estate property tax calculator**. effective property tax rates in new haven are the highest in the state of connecticut. the calculator allows one. New Haven Property Tax Rate.

From nariyjosselyn.pages.dev

California Sales Tax Rates 2024 Table Catie Evangeline New Haven Property Tax Rate owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. The countywide average effective rate is 2.38%. To calculate the property tax, multiply the assessment. Enter last name then space then 1st initial (example smith j) or business name (no. The city of new haven contracted with vision government. . New Haven Property Tax Rate.

From www.scribd.com

City Of New Haven Property Tax Bill PDF Taxes Property Tax New Haven Property Tax Rate the calculator allows one to enter a local street address, and then find out how much that property would be on the. The countywide average effective rate is 2.38%. estimated real estate property tax calculator**. To calculate the property tax, multiply the assessment. welcome to the new haven, ct online assessment database. The city of new haven. New Haven Property Tax Rate.

From www.visualcapitalist.com

Mapped The World's Biggest Private Tax Havens in 2021 New Haven Property Tax Rate effective property tax rates in new haven are the highest in the state of connecticut. welcome to the new haven, ct online assessment database. To calculate the property tax, multiply the assessment. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. The countywide average effective rate is. New Haven Property Tax Rate.

From wallethub.com

Property Taxes by State New Haven Property Tax Rate The countywide average effective rate is 2.38%. effective property tax rates in new haven are the highest in the state of connecticut. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. Enter last name then space then 1st initial (example smith j) or business name (no. The city. New Haven Property Tax Rate.

From exotbvrfi.blob.core.windows.net

What Is The Property Tax Rate In New Haven Ct at Robert Edwards blog New Haven Property Tax Rate enter the search criteria below: To calculate the property tax, multiply the assessment. the calculator allows one to enter a local street address, and then find out how much that property would be on the. welcome to the new haven, ct online assessment database. The countywide average effective rate is 2.38%. owners of real, personal and. New Haven Property Tax Rate.

From dailysignal.com

How High Are Property Taxes in Your State? New Haven Property Tax Rate estimated real estate property tax calculator**. enter the search criteria below: The city of new haven contracted with vision government. effective property tax rates in new haven are the highest in the state of connecticut. welcome to the new haven, ct online assessment database. the calculator allows one to enter a local street address, and. New Haven Property Tax Rate.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation New Haven Property Tax Rate the calculator allows one to enter a local street address, and then find out how much that property would be on the. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. enter the search criteria below: The city of new haven contracted with vision government. Enter last. New Haven Property Tax Rate.

From socialistvoice.ie

Ireland No. 1 tax haven for American corporations Socialist Voice New Haven Property Tax Rate the calculator allows one to enter a local street address, and then find out how much that property would be on the. Enter last name then space then 1st initial (example smith j) or business name (no. To calculate the property tax, multiply the assessment. owners of real, personal and motor vehicle property are taxed at a rate. New Haven Property Tax Rate.

From johanneslarsson.com

The 10 Best Tax Haven Countries in Europe for Entrepreneurs New Haven Property Tax Rate Enter last name then space then 1st initial (example smith j) or business name (no. To calculate the property tax, multiply the assessment. estimated real estate property tax calculator**. The countywide average effective rate is 2.38%. the calculator allows one to enter a local street address, and then find out how much that property would be on the.. New Haven Property Tax Rate.

From www.farfromblighty.com

EU tax haven blacklist set to shrink further, causing outcry Far From New Haven Property Tax Rate estimated real estate property tax calculator**. enter the search criteria below: The countywide average effective rate is 2.38%. To calculate the property tax, multiply the assessment. owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. Enter last name then space then 1st initial (example smith j) or. New Haven Property Tax Rate.

From kuvera.in

What is Tax Haven and How it Works? Kuvera New Haven Property Tax Rate owners of real, personal and motor vehicle property are taxed at a rate of $1 on every $1,000 assessed. The countywide average effective rate is 2.38%. the calculator allows one to enter a local street address, and then find out how much that property would be on the. To calculate the property tax, multiply the assessment. The city. New Haven Property Tax Rate.

From www.slideshare.net

Tax Havens , Major Tax Havens around the world. New Haven Property Tax Rate To calculate the property tax, multiply the assessment. welcome to the new haven, ct online assessment database. The city of new haven contracted with vision government. the calculator allows one to enter a local street address, and then find out how much that property would be on the. effective property tax rates in new haven are the. New Haven Property Tax Rate.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics New Haven Property Tax Rate enter the search criteria below: the calculator allows one to enter a local street address, and then find out how much that property would be on the. Enter last name then space then 1st initial (example smith j) or business name (no. estimated real estate property tax calculator**. The city of new haven contracted with vision government.. New Haven Property Tax Rate.

From www.undispatch.com

Top 10 Worst Corporate Tax Havens Corporate Tax Avoidance New Haven Property Tax Rate enter the search criteria below: The countywide average effective rate is 2.38%. welcome to the new haven, ct online assessment database. To calculate the property tax, multiply the assessment. effective property tax rates in new haven are the highest in the state of connecticut. Enter last name then space then 1st initial (example smith j) or business. New Haven Property Tax Rate.